Uncovering Financial Fraud: Harnessing Big Data and Machine Learning for Transaction Security

Introduction

Fraud in financial transactions poses a significant challenge to businesses, financial institutions, and consumers worldwide. With the rise of digital transactions, fraudulent activities have become more sophisticated, necessitating advanced methods for detection and prevention. Big Data analytics, combined with machine learning, offers a powerful approach to identifying fraudulent patterns in vast datasets. This chapter explores how Big Data technologies and machine learning algorithms can be leveraged to detect fraud in financial transactions, providing a comprehensive overview of techniques, challenges, and future directions.

The Nature of Financial Fraud

Financial fraud encompasses a wide range of illicit activities, including credit card fraud, money laundering, identity theft, and insider trading. These activities result in billions of dollars in losses annually, with the Association of Certified Fraud Examiners estimating global losses due to fraud at over $4 trillion per year. Fraudsters exploit vulnerabilities in financial systems, using techniques such as synthetic identities, account takeovers, and transaction laundering to evade detection.

Traditional rule-based systems for fraud detection, which rely on predefined thresholds and patterns, struggle to keep pace with evolving fraud tactics. These systems often generate high false-positive rates, flagging legitimate transactions as fraudulent, which leads to customer dissatisfaction and operational inefficiencies. Big Data analytics, paired with machine learning, addresses these limitations by enabling dynamic, data-driven fraud detection.

Big Data Analytics in Fraud Detection

Big Data analytics involves the processing and analysis of large, complex datasets to uncover hidden patterns, correlations, and anomalies. In the context of fraud detection, Big Data technologies enable the real-time analysis of massive volumes of transactional data, which is critical for identifying suspicious activities promptly.

Key Components of Big Data Analytics

Data Volume: Financial institutions process millions of transactions daily. Big Data platforms, such as Apache Hadoop and Apache Spark, can handle petabytes of data, allowing for comprehensive analysis.

Data Velocity: The speed at which transactions occur requires real-time or near-real-time processing. Stream processing frameworks like Apache Kafka and Apache Flink enable continuous data ingestion and analysis.

Data Variety: Financial data includes structured data (e.g., transaction amounts, timestamps) and unstructured data (e.g., customer communications, social media activity). Big Data tools integrate diverse data sources for a holistic view.

Data Veracity: Ensuring data accuracy and reliability is crucial. Data preprocessing techniques, such as cleaning and normalization, enhance the quality of insights derived from Big Data.

Benefits of Big Data in Fraud Detection

Scalability: Big Data platforms can scale to accommodate growing transaction volumes.

Real-Time Detection: Fast processing enables immediate identification of suspicious activities, reducing financial losses.

Comprehensive Analysis: Integrating multiple data sources provides a 360-degree view of customer behavior, improving detection accuracy.

Adaptability: Big Data systems can incorporate new data types and evolving fraud patterns, ensuring long-term effectiveness.

Machine Learning for Fraud Detection

Machine learning (ML) is a subset of artificial intelligence that enables systems to learn from data and improve over time without explicit programming. In fraud detection, ML algorithms analyze historical and real-time data to identify patterns indicative of fraudulent behavior.

Types of Machine Learning Approaches

Supervised Learning:

Definition: Supervised learning uses labeled datasets (e.g., transactions marked as "fraudulent" or "legitimate") to train models.

Algorithms: Logistic Regression, Decision Trees, Random Forests, Support Vector Machines (SVM), and Neural Networks.

Use Case: Predicting whether a transaction is fraudulent based on historical patterns.

Example: A credit card company trains a Random Forest model on past transactions to classify new transactions as fraudulent or legitimate.

Unsupervised Learning:

Definition: Unsupervised learning identifies patterns in unlabeled data, useful for detecting unknown or emerging fraud types.

Algorithms: K-Means Clustering, DBSCAN, Autoencoders, and Isolation Forests.

Use Case: Identifying anomalies in transaction data that deviate from normal behavior.

Example: An autoencoder detects unusual spending patterns in a customer’s account, flagging potential account takeover.

Semi-Supervised Learning:

Definition: Combines labeled and unlabeled data to improve model performance when labeled data is scarce.

Use Case: Enhancing fraud detection in scenarios with limited labeled fraud cases.

Example: A bank uses semi-supervised learning to refine fraud detection models with a small set of labeled fraud cases and a large pool of unlabeled transactions.

Reinforcement Learning:

Definition: An agent learns to make decisions by receiving feedback from its actions, optimizing for long-term goals.

Use Case: Dynamically adjusting fraud detection thresholds based on real-time feedback.

Example: A reinforcement learning model adjusts transaction approval thresholds to balance fraud prevention and customer experience.

Feature Engineering for Fraud Detection

Feature engineering is critical for building effective ML models. Key features for fraud detection include:

Transaction-Based Features: Amount, frequency, time of day, and location of transactions.

Behavioral Features: Customer spending patterns, device usage, and login frequency.

Network Features: Relationships between accounts, such as shared IP addresses or beneficiaries.

External Features: Geolocation data, social media activity, and credit scores.

Feature selection techniques, such as Principal Component Analysis (PCA) and Recursive Feature Elimination (RFE), reduce dimensionality and improve model performance.

Implementing a Fraud Detection System

Building a fraud detection system using Big Data and machine learning involves several steps:

Data Collection and Integration:

Collect transactional data from payment systems, customer relationship management (CRM) platforms, and external sources.

Use ETL (Extract, Transform, Load) pipelines to integrate and preprocess data.

Data Preprocessing:

Clean data to remove duplicates, missing values, and outliers.

Normalize or standardize numerical features to ensure consistency.

Encode categorical variables (e.g., transaction type) using techniques like one-hot encoding.

Model Training:

Split data into training, validation, and test sets.

Train multiple ML models and evaluate their performance using metrics like precision, recall, F1-score, and Area Under the ROC Curve (AUC-ROC).

Use cross-validation to prevent overfitting.

Real-Time Processing:

Deploy models on a Big Data platform (e.g., Apache Spark) for real-time inference.

Implement streaming pipelines to process incoming transactions continuously.

Model Evaluation and Monitoring:

Monitor model performance using metrics like false positive rate and detection rate.

Retrain models periodically to adapt to new fraud patterns.

Use explainability tools (e.g., SHAP, LIME) to interpret model decisions and ensure regulatory compliance.

Actionable Insights:

Flag suspicious transactions for manual review or automatic blocking.

Provide actionable insights to fraud analysts through dashboards and visualizations.

Case Study: Credit Card Fraud Detection

Consider a global bank implementing a fraud detection system for credit card transactions. The bank processes 10 million transactions daily, with 0.1% identified as fraudulent. Using Apache Spark for data processing and a Random Forest model for classification, the bank achieves the following:

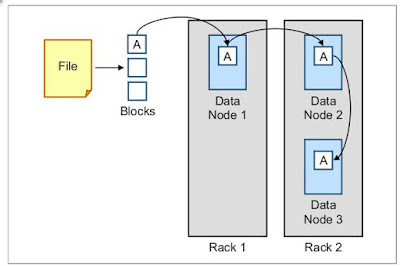

Data Pipeline: Transactions are ingested in real-time using Apache Kafka, processed with Spark Streaming, and stored in a Hadoop Distributed File System (HDFS).

Feature Engineering: Features include transaction amount, merchant category, time since last transaction, and geolocation distance.

Model Performance: The Random Forest model achieves 95% precision and 90% recall, significantly reducing false positives compared to rule-based systems.

Outcome: The bank reduces fraud losses by 30% and improves customer satisfaction by minimizing false positives.

Challenges in Fraud Detection

Despite its potential, fraud detection using Big Data and machine learning faces several challenges:

Imbalanced Datasets: Fraudulent transactions are rare, leading to imbalanced datasets that can bias models toward the majority class. Techniques like SMOTE (Synthetic Minority Oversampling Technique) and cost-sensitive learning address this issue.

Evolving Fraud Patterns: Fraudsters continuously adapt their tactics, requiring models to be retrained frequently.

Data Privacy: Regulations like GDPR and CCPA impose strict guidelines on handling personal data, necessitating secure data processing and anonymization.

Scalability: Processing large volumes of data in real-time requires significant computational resources and optimized algorithms.

Interpretability: Complex ML models, such as deep neural networks, are often "black boxes," making it difficult to explain decisions to regulators or customers.

Future Directions

The future of fraud detection lies in integrating emerging technologies with Big Data and machine learning:

Graph Analytics: Graph-based algorithms can detect complex fraud networks, such as money laundering rings, by analyzing relationships between entities.

Deep Learning: Advanced neural networks, like Graph Neural Networks (GNNs) and Long Short-Term Memory (LSTM) networks, can capture intricate patterns in sequential data.

Federated Learning: Enables collaborative model training across institutions without sharing sensitive data, enhancing privacy and scalability.

Explainable AI: Tools that provide transparent model explanations will improve trust and regulatory compliance.

Quantum Computing: Emerging quantum algorithms could accelerate fraud detection by solving complex optimization problems.

Conclusion

Fraud detection in financial transactions is a critical application of Big Data analytics and machine learning. By leveraging scalable data platforms and advanced algorithms, financial institutions can detect and prevent fraud with unprecedented accuracy and speed. While challenges like data imbalance and privacy concerns persist, ongoing advancements in technology promise to enhance the effectiveness of fraud detection systems. As fraudsters continue to evolve, so too must the tools and strategies used to combat them, ensuring a secure and trustworthy financial ecosystem.

Comments

Post a Comment