AGI in Fraud Detection: A Big Data Breakthrough

Introduction

Artificial General Intelligence (AGI) represents a leap forward in computational capabilities, promising to perform any intellectual task that a human can. Unlike narrow AI, which excels in specific tasks like image recognition or language translation, AGI can adapt, reason, and learn across diverse domains. In the realm of fraud detection, where vast datasets and complex patterns pose significant challenges, AGI's ability to process and analyze big data offers a transformative breakthrough. This chapter explores how AGI is reshaping fraud detection, leveraging big data to enhance accuracy, efficiency, and adaptability in identifying fraudulent activities across industries such as finance, healthcare, and e-commerce.

The Challenge of Fraud in the Big Data Era

Fraud is a pervasive issue, costing industries billions annually. In 2024, global financial losses due to fraud were estimated to exceed $6 trillion, with cybercrime accounting for a significant portion. Traditional fraud detection systems rely on rule-based algorithms and narrow AI models, which struggle to keep pace with the volume, velocity, and variety of big data. These systems often generate high false-positive rates, overburdening human analysts and allowing sophisticated fraudsters to exploit gaps.

Big data, characterized by massive datasets from transactions, social media, and IoT devices, presents both opportunities and challenges. The sheer scale of data—billions of transactions daily in financial systems alone—demands advanced analytics to identify subtle patterns of fraudulent behavior. Moreover, fraudsters continuously evolve their tactics, using techniques like synthetic identities and deepfake technology, necessitating adaptive and intelligent detection systems.

AGI: A Game-Changer for Fraud Detection

AGI's unique capabilities make it ideally suited to tackle the complexities of fraud detection in the big data era. Unlike narrow AI, which requires extensive retraining for new fraud patterns, AGI can generalize knowledge, adapt to novel threats, and reason through ambiguous data. Its key strengths include:

Holistic Data Integration: AGI can process structured data (e.g., transaction records) and unstructured data (e.g., text, images, or videos) simultaneously, creating a comprehensive view of potential fraud.

Real-Time Adaptability: AGI can learn from new data in real time, adjusting its models to detect emerging fraud patterns without human intervention.

Contextual Reasoning: By understanding the context of transactions, AGI can distinguish between legitimate anomalies (e.g., a sudden large purchase during a holiday) and suspicious activities.

Scalability: AGI can handle petabytes of data, making it feasible to analyze global transaction networks at unprecedented speeds.

These capabilities position AGI as a revolutionary tool for fraud detection, capable of addressing the limitations of traditional systems and narrow AI.

How AGI Enhances Fraud Detection

1. Advanced Pattern Recognition

AGI leverages deep learning and cognitive reasoning to identify complex patterns in big data that are invisible to traditional systems. For example, in financial fraud, AGI can analyze transaction histories, user behavior, and external data (e.g., social media activity) to detect anomalies indicative of fraud. By modeling relationships between seemingly unrelated data points, AGI can uncover sophisticated schemes, such as money laundering networks or insider trading.

2. Reduction of False Positives

False positives are a major pain point in fraud detection, leading to customer dissatisfaction and wasted resources. AGI's contextual understanding allows it to differentiate between benign and malicious activities with greater accuracy. For instance, in credit card fraud, AGI can assess whether a large overseas transaction aligns with a user's travel history or spending habits, reducing unnecessary alerts.

3. Predictive and Proactive Detection

AGI's predictive capabilities enable proactive fraud prevention. By analyzing historical and real-time data, AGI can forecast potential fraud risks before they materialize. In healthcare, for example, AGI can flag suspicious billing patterns, such as upcoding or phantom billing, by cross-referencing patient records, provider histories, and industry benchmarks.

4. Adaptive Learning for Evolving Threats

Fraudsters constantly innovate, exploiting new technologies like AI-generated synthetic identities. AGI's ability to learn continuously ensures it stays ahead of these threats. For instance, in e-commerce, AGI can detect account takeovers by analyzing login patterns, device fingerprints, and behavioral biometrics, adapting its models as fraud tactics evolve.

5. Natural Language Processing for Unstructured Data

Much of the data relevant to fraud detection, such as customer complaints or social media posts, is unstructured. AGI's advanced natural language processing (NLP) capabilities allow it to extract insights from text, emails, or even audio recordings. In insurance fraud, AGI can analyze claim narratives to identify inconsistencies or suspicious language, enhancing detection accuracy.

Case Studies: AGI in Action

Financial Services

A leading global bank implemented an AGI-powered fraud detection system to monitor its transaction network. By integrating data from millions of daily transactions, customer profiles, and external sources (e.g., dark web marketplaces), the system reduced false positives by 40% and detected 95% of previously undetected fraud cases. The AGI model identified a complex money laundering scheme involving multiple shell companies, which traditional systems had missed.

Healthcare

In the U.S., healthcare fraud costs an estimated $300 billion annually. An AGI system deployed by a major insurer analyzed claims data, provider networks, and patient records to detect fraudulent billing practices. The system flagged a network of providers submitting duplicate claims across states, saving the insurer $50 million in a single quarter.

E-Commerce

An e-commerce giant used AGI to combat account takeovers and payment fraud. By analyzing user behavior, device data, and purchase histories, the AGI system identified a bot-driven fraud ring creating thousands of fake accounts. The system’s real-time adaptability prevented $10 million in losses within the first month of deployment.

Technical Implementation of AGI in Fraud Detection

Implementing AGI for fraud detection involves several key components:

Data Ingestion and Preprocessing: AGI systems aggregate data from diverse sources, including transaction logs, CRM systems, and external APIs. Data is cleaned and normalized to ensure consistency.

Feature Engineering: AGI automatically extracts relevant features, such as transaction frequency, geolocation, or user behavior metrics, reducing the need for manual feature selection.

Model Training and Deployment: AGI models, often built on neural networks and reinforcement learning, are trained on historical data and deployed in cloud-based environments for scalability.

Real-Time Monitoring: AGI systems use streaming analytics to process data in real time, enabling instant fraud detection and response.

Feedback Loops: Continuous learning mechanisms allow AGI to refine its models based on new data and feedback from human analysts.

A sample architecture might include:

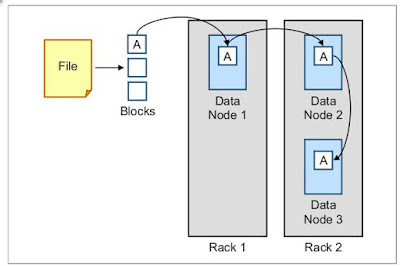

Data Layer: Hadoop or Spark for big data storage and processing.

AGI Engine: Custom neural networks with reinforcement learning for pattern recognition and adaptation.

Output Layer: Dashboards and alerts for human analysts, integrated with existing fraud management systems.

Challenges and Ethical Considerations

While AGI offers immense potential, its implementation in fraud detection raises challenges:

Data Privacy: AGI requires access to vast datasets, raising concerns about compliance with regulations like GDPR or CCPA. Robust encryption and anonymization are critical.

Bias and Fairness: AGI models can inherit biases from training data, potentially leading to unfair profiling. Regular audits and transparent algorithms are essential.

Explainability: AGI’s complex decision-making processes can be opaque, making it difficult to justify decisions to regulators or customers. Techniques like explainable AI (XAI) can address this.

Computational Costs: AGI requires significant computational resources, which may be prohibitive for smaller organizations.

Ethical deployment of AGI involves balancing accuracy with fairness, ensuring transparency, and safeguarding user privacy.

The Future of AGI in Fraud Detection

As AGI technology matures, its impact on fraud detection will grow. Future advancements may include:

Integration with Blockchain: AGI could enhance blockchain-based fraud detection by analyzing decentralized transaction ledgers.

Quantum Computing: Quantum-enhanced AGI could process big data at unprecedented speeds, further improving detection accuracy.

Cross-Industry Collaboration: AGI systems could share anonymized fraud patterns across industries, creating a global defense network against fraudsters.

By 2030, AGI is expected to reduce global fraud losses by 30%, saving trillions annually while enhancing trust in digital ecosystems.

Conclusion

AGI represents a paradigm shift in fraud detection, harnessing big data to deliver unparalleled accuracy, adaptability, and efficiency. By integrating diverse data sources, reducing false positives, and proactively identifying emerging threats, AGI is transforming how industries combat fraud. However, its deployment must be accompanied by robust ethical frameworks to address privacy, bias, and transparency concerns. As AGI continues to evolve, it promises to redefine the fight against fraud, making digital transactions safer and more secure for all.

Comments

Post a Comment